Tendance maintenant

EQUIPEMENT

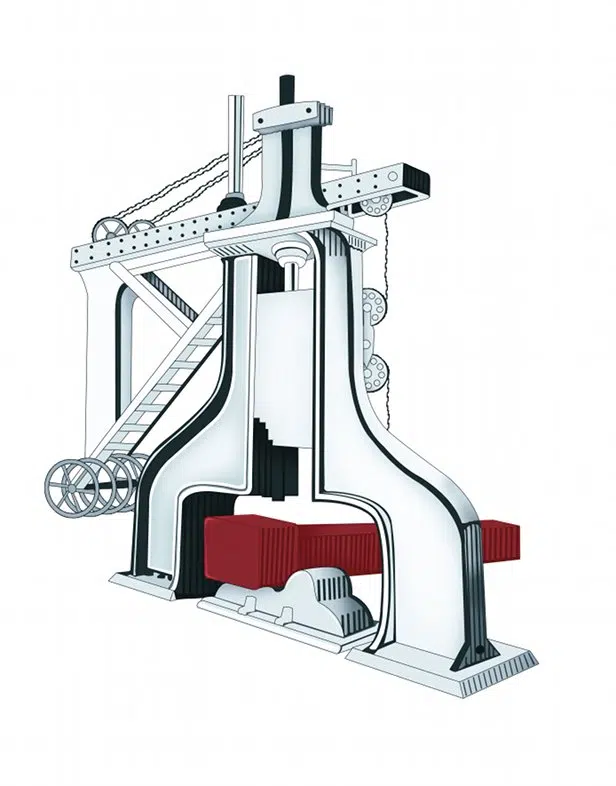

Sélectionner un ressort de traction : critères essentiels et conseils

La sélection d'un ressort de traction est fondamentale dans la conception de dispositifs mécaniques. Plusieurs critères doivent guider ce choix pour assurer la performance...

FITNESS

Meilleure application fitness gratuite : comparatif et avis pour choisir

Gratuité ne rime pas toujours avec fonctionnalités limitées. Certaines applications de fitness gratuites surpassent leurs concurrentes payantes dans le suivi des progrès, la diversité...

Le pilate La Roche-sur-Yon, une méthode douce et complète pour se...

Inventée il y a une trentaine d'années par Joseph Pilates, la méthode qui porte son nom ne cesse de gagner en popularité auprès des...

NEWS

NUTRITION

Optimisez vos séances d’entraînement en évitant ces aliments

Pour maintenir une santé optimale, vous devez suivre une alimentation saine et équilibrée. Malgré l'importance de ce régime, certains aliments peuvent entraver votre performance...

Poudre de protéines : sûre pour la musculation ? Risques et bénéfices

Les adeptes de musculation cherchent souvent à optimiser leurs résultats, et la poudre de protéines est devenue un complément prisé dans leur quotidien. Les...

Protéines végétariennes : Comment en obtenir en quantité suffisante ?

On a beau vanter la modernité, rares sont ceux qui osent croiser le regard d’une assiette sans viande sans un brin de scepticisme. Entre...

Les aliments à éviter pour une digestion optimale avant une compétition sportive

La préparation avant une compétition sportive est primordiale pour les athlètes, et l'alimentation joue un rôle clé dans cette préparation. Effectivement, une digestion optimale...

Alimentation muscle : quel aliment pour prendre du muscle rapidement ?

Pour ceux qui cherchent à maximiser leur prise de masse musculaire, l'alimentation joue un rôle fondamental. Les protéines sont souvent mises en avant, mais...

SPORT

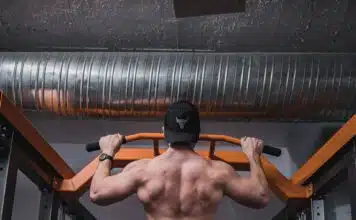

Les secrets des entraîneurs de sport

La réussite d'un athlète est en partie favorisée par le travail qui a été effectué avec le coach avant la compétition. Ce résultat est...